In the period of 1991-2022 one of the major transitions that former socialist countries had to undergo was the transition of their energy systems. Energy systems during socialist times heavily relied on coal, even though the share of coal in the energy mix of the countries was decreasing in most of the countries during the second half of the 20th century. Therefore, one of the key tasks of these countries faced was to make their energy systems more eco-friendly. Besides, they had to deal with the issue of reliance on import of Russian gas and oil, since very high energy import consolidation made them strategically vulnerable. In this article we examine how Visegrand countries and Romania have coped with these tasks and what are the reasons for the differences in the current state of their energy systems.

Czech Republic

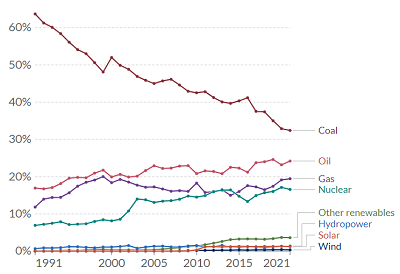

Table 1: Share of energy consumption by source, Czechia[1]

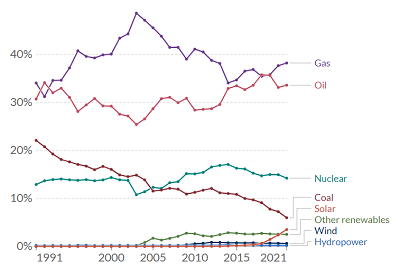

By 1991, Czech energy system was very dependent on coal, as coal amounted for 63,68% of Czech energy consumption. By 2021 the country had managed to decrease the share of coal to 32,34%, replacing it mainly by oil and gas. As for oil&gas, Czechia is traditionally dependent on import from Russia. However, Czech oil import, in contrast to gas import, demonstrates a diversification trend. Azerbaijan and Kazachstan are key partners of Czech republic in this regard: the share of Azerbaijan decreased dramatically in 2001-2005, Kazachstan share has also increased in 2010s. Another potential oil importer to Czech Republic is the US[2]. Gas import, in its turn, shows no sign of diversification, what is more, a completely reverse trend can be observed: while in early 2000s Czech Republic imported gas both from Norway and Russia, since 2012 Russia is an exclusive gas exporter to Czechia[3].

Nuclear energy is another major energy source for the country. Currently Czechia has two nuclear power plants (6 reactors in sum) in Temelín and Dukovany. Dukovany Power Plant is the older one, its operation began in 1985. Temelín Power Plant construction began in 1981 and initially 4 reactors with capacity approximately 1000 MW were planned (for comparison, reactors in Dukovany only have a capacity of 500 MW). However, in 1990 Czechoslovak government of Petr Pithart decreased the number of planned reactors from 4 to 2[4]. The power plant began operation in 2002, which increased the share of nuclear energy in Czech energy balance from 8,57% in 2001 to 13,99% in 2003. In 2004-2006 plans to build two more nuclear reactors appeared and in 2009 ČEZ- a mainly Czech conglomerate of energy companies- launched a tendering process. However, in 2014 the tender was cancelled as ČEZ failed to get state guarantees[5]. It is also important to mension that ČEZ has become a major regional player on energy market. The company participated in nuclear energy plants projects in Slovakia and Romania. In contrast to this, in other countries of the region most of companies that deal with nuclear energy do not have international ambitions.

Slovakia

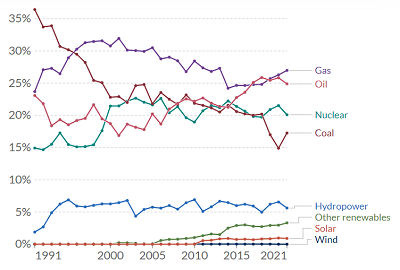

Table 2: Share of energy consumption by source, Slovakia[6]

In contrast to Czech Republic, Slovakia had susbstantially lower share of coal in its energy balance in 1991: 36,43%. Instead, gas, oil and nuclear sources played a more significant role. During the period of 1991-2021 Slovakia managed to decrease the share of coal in its energy mix to 17,26%. The share of coal fell especially quickly in 1990s, when Slovakia substantially raised its gas consumption as well as started operating Mochovice nuclear power plant in 1998. It is worth mentioning, that in contrast to the Czech Republic, Slovakia is much more dependent on Russian energy import due to a lower level of diversification: it imports from Russia approximately 75% of oil[7] and 87% of natural gas[8], as a result approximately 46-47% of energy consumed in Slovakia in 2021 came from Russian energy import, while in the Czech Republic the indicator was only 30%.

Nuclear power plays an important role in Slovak energy mix- since 1998 its share accounts to 20-22% of total energy consumption, which is the biggest share among the countries examined. There are two nuclear power plants in Slovakia- Mochovce Nuclear Power Plant and Bohunice Nuclear Power Plant with a total of five active reactors. Power plant in Bohunice is one of the oldest in the region as it was constructed in 1958-1972. Initially it had 4 reactors with a capacity of 400-500 MW and 1 small capacity reactor (less then 100 MW), which was decommissioned before 1991. Slovakia had to shut down two reactors when joining the EU (they were decommissioned in 2006-2008) due to that they did not comply with the EU regulations. It also has plans to build one more high-capacity reactor (1200 MW) to eventually replace two old reactors and even raise the output of the power plant. These plans were announced for the first time in 2009 by Slovak Prime Minister Robert Fico and Czech Prime Minister Jan Fischer. Initially a joint Czech-Slovak project of building reactors in Slovak Bohunice and Czech Temelín by Slovak Nuclear and Decommissioning Company (JAVYS) and the Czech energy company ČEZ was planned, however later the construction of reactors in Temelín was cancelled, as was mentioned above. Currently the reactor in Bohunice is planned to enter service by 2031. In Mochovice Power Plant there are 3 active reactors with medium capacity (470 MW), one of them entering service in 2022. Apart from this, one more reactor is currently on the final stage of construction, therefore one can expect the share of nuclear energy in Slovak energy balance to rise to approximately 25% in 2020s. On top of that, in the period of 1991-1995 Slovakia has started to actively use its hydro power potential with hydropower providing 5-7% of the energy consumption of the country. All this indicates that Slovakia has relatively good opportunities for raising the share of energy produced neither from coal nor from Russian energy import.

Poland

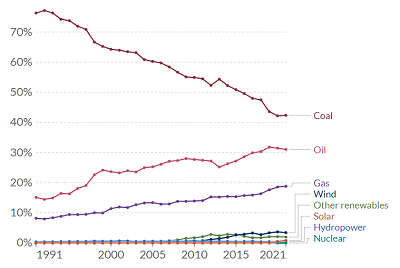

Table 3: Share of energy consumption by source, Poland[9]

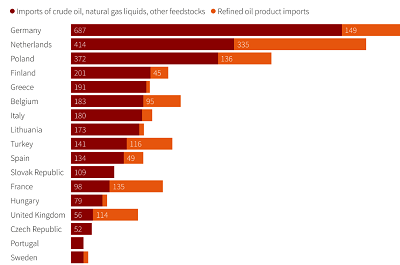

In comparison to other countries examined in this article, by 1991 Poland had the biggest share of coal in its energy balance. It was caused by the fact that Poland has substantial coal resources, therefore its energy system heavily relied on domestic coal. Even though the share of coal has been consistently decreasing for the whole period of 1991-2021, its share is still much higher than in other countries examined- 42,38%. On top of that, Poland imports part of consumed coal from Russia, which increases the vulnerability of Polish energy balance[10]. During the period of 1991-2021 coal as the main energy source has been consistently replaced by oil and gas- their shares grew from 15,13% to 31,02% and from 8,19% to 18,84% respectively. Same as other countries examined, initially Poland heavily relied on Russian import of oil and gas, however after the 2014 crisis it began the diversification of import of both energy sources. Since 2016 Poland has started to purchase gas from Qatar. In 2019 it also started to import American LNG (Liquefied natural gas)[11]. Poland has also started to diversify its oil import in 2016 by purchasing oil from different countries with Saudi Arabia being its main partner in this regard[12]. However, it is worth mentioning that by 2021 Poland imported in total much more oil and oil products from Russia than any other country examined[13]. Generally even though Poland remains dependent on Russian oil and gas, a positive trend can be observed.

Table 4: Total energy imports of European countries from Russia

As for nuclear energy, due to its heavy reliance on domestic coal Poland did not have nuclear power plants for a while and the first one- Żarnowiec Nuclear Power Plant- started to be constructed later then in other countries examined- in 1982. It had not been finished before the collapse of socialist system and the new democratic government faced serious public opposition to finishing the power plant project, caused by fears after the Chernobyl disaster in 1986. In 1990 a referendum took place with the majority of voters opting against the completion of the power plant. After the referendum the construction was cancelled. However, with time public opposition to nuclear energy weakened and Polish society has generally started to support the idea of building nuclear power plants, therefore Polish government returned to these plans. In 2014 Nuclear Power Program was adopted by Donald Tusk government. In the late 2010s and early 2020s Polish PGE Polska Grupa Energetyczna started the project of building new nuclear reactors in Poland. In 2021 Polskie Elektrownie Jądrowe, a state-owned firm, was charged with a responsibility to build 6 reactors. As for energy from sustainable sources, their share is relatively small (1,97% for renewables), with wind energy starting to play the most significant role in 2010s.

Hungary

Table 5: Share of energy consumption by source, Hungary[14]

The energy balance of Hungary in 1991 differed significantly from the three countries examined above. The share of coal in energy sources was relatively small (22,1%), while the share of gas, oil and nuclear energy was relatively big (34,06%, 30,72% and 12,91% respectively). Therefore, Hungary from the very beginning had a more comfortable energy balance then other countries of the region. Hungary has managed to decrease the share of coal to a tiny 5,96%, which is definitely a significant success in comparison to other countries examined. However, Hungary was much less successful with the policy of diversification of oil&gas imports. This was mostly due to the fact that in 2010s, when most of the countries in the region started their diversification policies, Fidesz came to power in Hungary. Since Fidesz was much more tolerable towards Russia in its foreign policy, it did not see Russian monopoly on energy supply as a threat. It is also worth mentioning that Hungary is a reverse exporter of gas to Ukraine with its export increasing significantly in 2017-2019[15].

Hungary has a relatively well-developed nuclear system- its sole Paks Nuclear Power Plant was built after the oil crisis of 1970s and it has 4 active reactors, which cover a large share of Hungarian energy consumption. However, during the period after 1991 Hungary was reluctant to build new reactors for a long period of time. Only in 2014 a decision was made to build 2 new reactors and it was already in 2022 when the decision was made to choose Russian state-owned Rosatom for the project[16]. Among renewable sources solar power plays the most significant role in Hungary with its share starting to increase rapidly in 2018-2021.

Romania

Table 5: Share of energy consumption by source, Romania[17]

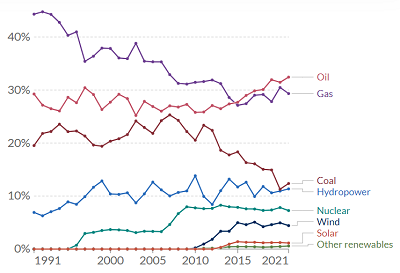

The energy balance of Romania in 1991 also had a unique structure. It contained the smallest share of coal among the countries examined (19,52%) and big shares of gas (44,32%) and oil (29,25%). Romania also had a number of hydro power plants which produced 6,91% of consumed energy. During the period of 1991-2011 the share of coal did not decrease at all, however since 2012 a sharp decrease can be observed, which results in the share of coal as Romanian energy source being only 12,37% by 2021. During 1991-2015 gas consumption also shrank as Romania started operating its first nuclear power plant- Cernavodă Nuclear Power Plant- in 1996 with one active reactor and started to operate another one in 2007. Romania also has had plans of constructing some more reactors for a while: in 2009 Nuclearelectrica, ArcelorMittal, ČEZ, GDF Suez, Enel, Iberdrola and RWE formed a company Energonuclear to build 3rd and 4th reactors of Cernavodă Nuclear Power Plant. However, in 2010s the project collapsed due to economic and market-related uncertainties. In 2022 Romania has secured a loan of 3 bln dollars for the construction of 2 nuclear reactors from the USA. It has prevented Romania from cooperation with China on the project[18].

Romania has also increased the use of hydropower in 1991-1997 from 6,91% to 8,89%. The volatility of hydro power plants output due to weather conditions used to be compensated by producing more energy from coal, even though the trend cannot be observed after 2016. Apart from this, Romania has also increased its wind power energy production share to 4,97% during the period of 2010-2015.

2022 crisis

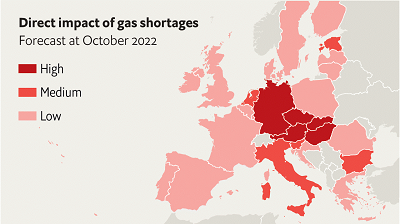

The year of 2022 has posed a major challenge for the energy systems of the countries examined. Their heavy reliance on Russian energy import resulted in severe damage inflicted by shortages of Russian oil&gas supply to their economies. Generally Central Eastern Europe is supposed to be the European subregion that was hit by the current energy crisis most heavily.

Table 6: Direct impact of gas shortages on EU countries[19]

This heavy reliance can be explained both by soviet bloc heritage and by geographical location in the center of Europe, which predetermined the transit role for the supply of Russian oil&gas to Europe. Russian Transgas gas pipeline passes through the territory of Slovakia and Czechia while Jamal pipeline passes through Polish territory. Transgas is accompanied by Southern Druzhba oil pipeline and Yamal with Northern Druzhba. During the period of 1991-2021 the countries developed oil&gas infrastructure including gas storages, however this factor caused their overdependence on Russian energy import. It is worth mentioning that Romania was located quite far from main oil&gas pipelines, which is also reflected in its smaller dependence on Russia.

Table 7: Oil&gas pipelines in Europe[20]

In 2022 the countries faced a necessity to find a replacement for Russian oil&gas as soon as possible since Russia could no longer be considered to be a reliable partner. The main alternatives for Russian gas is American and Saudi Arabian LNG, however, it would be problematic to increase its import substantially due to the lack of capacities until the middle of 2020s[21]. Central European countries can also compensate Russian energy import shortages by cooperation with alternative importers such as Norway and Azerbaijan. It is important to mention that when switching from Russian gas to LNG the countries face a risk of falling into dependence on American LNG, the supply of which is highly vulnerable to weather conditions[22]. On top of that, if the countries will not be able to get LNG from different trade partners this will mean that energy import remains overconsolidated, which causes substantial strategic risks. However, in this regard one should not forget that, as was described above, Central European countries has experience of importing energy from Saudi Arabia, Norway, Azerbaijan and other countries, which may help in reaching the long-anticipated goal of energy import diversification.

The ongoing crisis has created opportunities for some countries of the region, while challenges for the others. For example, under the current conditions Romania has a chance to become a regional energy leader. It is the second largest gas producer in the EU after the Netherlands and has potential for expanding its gas production as it has unexplored gas reserves in the Black Sea[23]. On the other hand, Hungary, which in 2010s opted for closer ties with Russia in energy sector, found itself in a complicated position with the beginning of the war in Ukraine- the vulnerability of Hungarian economy to the risk of energy shortage was bigger than in other countries, which required from Hungarian government to be more sceptic towards EU sanctions against Russia in energy sector which in turn caused additional tensions between Brussel and Budapest. This demonstrates that diversifying energy import is crucial for ensuring the room to maneuver in the political field.

Conclusion

Generally, a conclusion can be made that all of the countries examined in the period of 1991-2021 substantially changed their energy balances. All of them decreased the share of coal in their energy balance with oil and gas being the most popular alternatives, however more active usage of these energy sources posed a threat of overrelying on import from Russia. In some cases the countries have started the process of diversification of their oil&gas import, however the level of diversification had been far from sufficient by 2022. Nuclear power seems to be the most beneficial energy source for the countries as it can both decrease the share of coal in their energy balances and does not cause dependence on Russian import. However, the process of building nuclear power plants is very complicated as it requires a lot of investment while profit does not come in the short run. Therefore, an active participation of state by either providing state guarantees or participating directly through state-owned enterprises is needed. Apart from this, public opposition to nuclear energy used to be a serious obstacle to the process, even though with time nuclear energy has gained a better image in the region. Since all of the countries examined are planning to build new reactors or are already constructing them, one can expect an increase of the role of nuclear energy in 2020s and 2030s. Finally, it is worth mentioning that green energy with the exception of hydro energy is still not sufficiently developed and in most cases no positive dynamics can be observed, even though we believe that in current complicated conditions the expansion of nuclear power plants should be prioritized.

References:

[1] H. Ritchie, M. Roser Czechia: Energy Country Profile. – Our World In Data URL: https://ourworldindata.org/energy/country/czech-republic

[2] Crude oil net imports in the Czech Republic, 2000-2020. – IEA. URL: https://www.iea.org/data-and-statistics/charts/crude-oil-net-imports-in-the-czech-republic-2000-2020

[3] Natural gas net imports in the Czech Republic, 2000-2020. – IEA. URL: https://prod.iea.org/data-and-statistics/charts/natural-gas-net-imports-in-the-czech-republic-2000-2020

[4] Historie výstavby Jaderné elektrárny Temelín . – Ekolist.cz URL: https://ekolist.cz/cz/zpravodajstvi/zpravy/historie-vystavby-jaderne-elektrarny-temelin

[5] ČEZ cancels Temelín tender after government says no to guarantees. – Radio Prague International. URL: https://english.radio.cz/cez-cancels-temelin-tender-after-government-says-no-guarantees-8298969

[6] H. Ritchie, M. Roser Slovakia: Energy Country Profile. – Our World In Data URL: https://ourworldindata.org/energy/country/slovakia

[7] International energy Agency statistics

[8] S. Velasco The pipeline that could help Slovakia become less dependent on Russian gas with Polish help. Warsaw Institute. URL: https://warsawinstitute.org/pipeline-help-slovakia-become-less-dependent-russian-gas-polish-help/

[9] H. Ritchie, M. Roser Poland: Energy Country Profile. – Our World In Data URL: https://ourworldindata.org/energy/country/poland

[10] Value of coal imports from Russia to Poland from 2000 to 2020. – Statista.com URL: https://www.statista.com/statistics/1295086/poland-coal-imports-value-from-russia/

[11] Natural gas net imports in Poland, 2000-2020. – IEA. URL: https://www.iea.org/data-and-statistics/charts/natural-gas-net-imports-in-poland-2000-2020

[12] Crude oil net imports in Poland, 2000-2020. – IEA. URL: https://www.iea.org/data-and-statistics/charts/crude-oil-net-imports-in-poland-2000-2020

[13] Factbox: How much oil does the European Union import from Russia? // Reuters URL: https://www.reuters.com/world/europe/how-much-oil-does-european-union-import-russia-2022-04-06/

[14] H. Ritchie, M. Roser Hungary: Energy Country Profile. – Our World In Data URL: https://ourworldindata.org/energy/country/hungary

[15] Natural gas net imports in Hungary, 2000-2020. – IEA. URL: https://www.iea.org/data-and-statistics/charts/natural-gas-net-imports-in-hungary-2000-2020

[16] C. Digges. Hungary moves forward with Russian-built nuclear plant, despite war. – Bellona. URL: https://bellona.org/news/nuclear-issues/2022-08-hungary-moves-forward-with-russian-built-nuclear-plant-despite-war

[17] H. Ritchie, M. Roser Romania: Energy Country Profile. – Our World In Data URL: https://ourworldindata.org/energy/country/romania

[18] Romania: 3 billion dollars from the US for the construction of two new reactors. – NOVA.news URL: https://www.agenzianova.com/en/news/romania-3-miliardi-di-dollari-dagli-usa-per-la-costruzione-di-due-nuovi-reattori/

[19]The countries most at risk from Europe’s energy crunch. – The Economist. URL: https://www.economist.com/graphic-detail/2022/10/11/the-countries-most-at-risk-from-europes-energy-crunch

[20] J. Kubica. ResearchGate. URL: https://www.researchgate.net/figure/Map-of-oil-and-gas-pipelines-from-Russia-credit-US-Energy-Information-Administration_fig2_268047847

[21] LNG Can’t Replace Russian Gas. – Energy Intellience. URL: https://www.energyintel.com/0000017f-637f-d86c-a3ff-6b7fd42b0000

[22] Why Europe’s Dependence On U.S. LNG Is Risky. – yahoo!finance. URL: https://finance.yahoo.com/news/why-europe-dependence-u-lng-170000953.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAMNP2sfXtXKJ0bnXcwM4hiqKTQxeROwJecPKBHXs923flZiGIpJ9-ERw7xwlAjtcyB0-jowJnu3HUr0peQ8_25_H5s3gcgO6KsVVar60Gd5fJYDUmwadY3rEZgMtmqPk6Pxu_cS9RljMVk3bTYVaAzQOPEvxU0ZEWJ5FzpztbVxz

[23] Romania only place in EU where natural gas production can increase, NGO says. – Romania-Insider.com. URL: https://www.romania-insider.com/romania-natural-gas-production-can-increase-aug-2022